Financial Literacy for Middle School | Lessons & Activities

Financial literacy for middle school isn’t optional in our house. By ages 10–14, kids are already making spending decisions, earning small amounts of money, and forming habits that stick.

Before I became a homeschool mom, I worked as a finance director, so teaching money skills at home has always felt non-negotiable.

Over the years, I’ve focused on practical money skills, budgeting, saving, understanding debit vs. credit, and learning how interest actually works.

Below you’ll find the lessons, curriculum options, books, and hands on activities that have worked for us.

**This post may contain affiliate links. As an Amazon Associate and a participant in other affiliate programs, I earn a commission on qualifying purchases.**

Essential Financial Knowledge for Middle Schoolers

By ages 12–14, kids are already handling money in small but meaningful ways, spending birthday cash, saving for something specific, or asking about debit cards. This is the stage where money habits start forming.

At this age, they need to understand the difference between debit and credit. A debit card pulls from money they already have. A credit card borrows money and has to be paid back, usually with interest if it’s not paid in full.

Budgeting should move from theory to practice. Even a simple system, splitting money into spending, saving, and giving, helps them see where it goes and how fast it disappears.

They also need to know how savings accounts work and why interest matters. Watching money grow, even slowly, makes the concept real.

This is the right time to talk about needs versus wants, impulse spending, and delayed gratification. Those conversations matter more than memorizing definitions.

Earning money is just as important. Whether it’s chores, small neighborhood jobs, or selling something they’ve made, earning changes how they view spending.

How Earning Money Builds Financial Literacy in Middle School

Earning money is often the first time financial literacy becomes real for middle schoolers. When they’ve worked for it, even a small amount, spending decisions suddenly feel different.

At this age, earning creates a natural entry point into budgeting. If they make $20 mowing a lawn, they immediately face choices: spend it all, save part of it, or set a goal. That simple decision introduces core concepts like allocation, delayed gratification, and opportunity cost without turning it into a lecture.

Saving becomes more meaningful too. Putting aside money they’ve earned themselves, rather than received as a gift, builds ownership. Watching that savings grow, even slowly, reinforces why interest and long-term planning matter.

Earning also helps them understand value. Time spent babysitting or doing yard work translates directly into dollars. That connection makes impulse purchases easier to question and larger goals easier to prioritize.

For middle school students, the goal isn’t income, it’s perspective. Small jobs, creative projects, seasonal work, or helping neighbors all provide hands-on experience with effort, income, and responsibility. Those experiences lay the groundwork for stronger money habits in high school and beyond.

Middle School Financial Literacy Curriculum Options

If you prefer a structured approach rather than piecing lessons together yourself, there are several solid curriculum options designed specifically for ages 10–14.

Moneytime is the program we’ve used during middle school. It’s self-directed, which means students can work independently without heavy parent prep. The course includes 30 modules, quizzes, and completion certificates, making it easy to track progress.

Mr. D Math offers a middle school economics course, along with a half-credit high school option for older students who want something more formal.

Beyond Personal Finance focuses on real-world scenarios teens will actually face, credit, debt, budgeting after graduation, so it feels more applied and less theoretical.

Money Management Games for Middle School

Games are one of the easiest ways to make money concepts stick. Instead of financial literacy worksheets, students get to make decisions, take risks, and see consequences play out in real time.

These board games reinforce budgeting, investing, supply and demand, and long-term thinking without feeling like a formal lesson.

- Financial literacy crossword printable – A simple way to review key terms and reinforce vocabulary.

- The Entrepreneur – Focuses on building and managing a business while handling expenses and revenue.

- Stock Exchange Market Game – Introduces investing basics and how market changes affect decisions.

- Rich Dad Cashflow – Teaches income streams, assets, and long-term financial strategy in a game format.

- Bulls and Bears – A stock market simulation that shows how timing and risk impact returns.

- Monopoly – A classic, but still useful for discussing cash flow, property value, and financial trade-offs.

Stock Market Games for Kids

Stock market games are a practical way to introduce investing concepts without real financial risk. For middle school students, they make abstract ideas like shares, risk, and long-term growth easier to understand.

Simulated trading games allow students to track stocks, follow market changes, and see how decisions affect outcomes over time. Even simple classroom-style investment challenges can open conversations about diversification, patience, and why timing the market is difficult.

Used alongside budgeting and saving lessons, stock market simulations help round out financial literacy by showing how money can grow, and how quickly it can change.

Books We’ve Used for Middle School Money Lessons

I’ve found that money conversations stick better when they’re tied to a book rather than a lecture. Some sparked good discussions in our house. Others helped explain concepts I didn’t want to overcomplicate.

Here are the financial literacy books that actually worked for us:

- The Economics Book: Big Ideas Simply Explained – This one is dense, so we didn’t read it cover to cover. Instead, we dipped into specific topics when questions came up. It’s helpful for explaining the bigger picture behind how markets work.

- The Infographic Guide to Personal Finance – Freddie prefers visuals, so this format made more sense than a traditional finance book. The charts and summaries make things like taxes and investing less abstract.

- Investing for Kids – This was useful once we started talking about the stock market more seriously. It connects investing to real goals instead of just numbers on a screen.

- Finance 101 for Kids – A solid starting point for budgeting and basic money habits. It’s straightforward without feeling babyish.

- How to Turn $100 into $1,000,000 – This one shifts the focus toward long-term thinking. It’s less about quick wins and more about building habits.

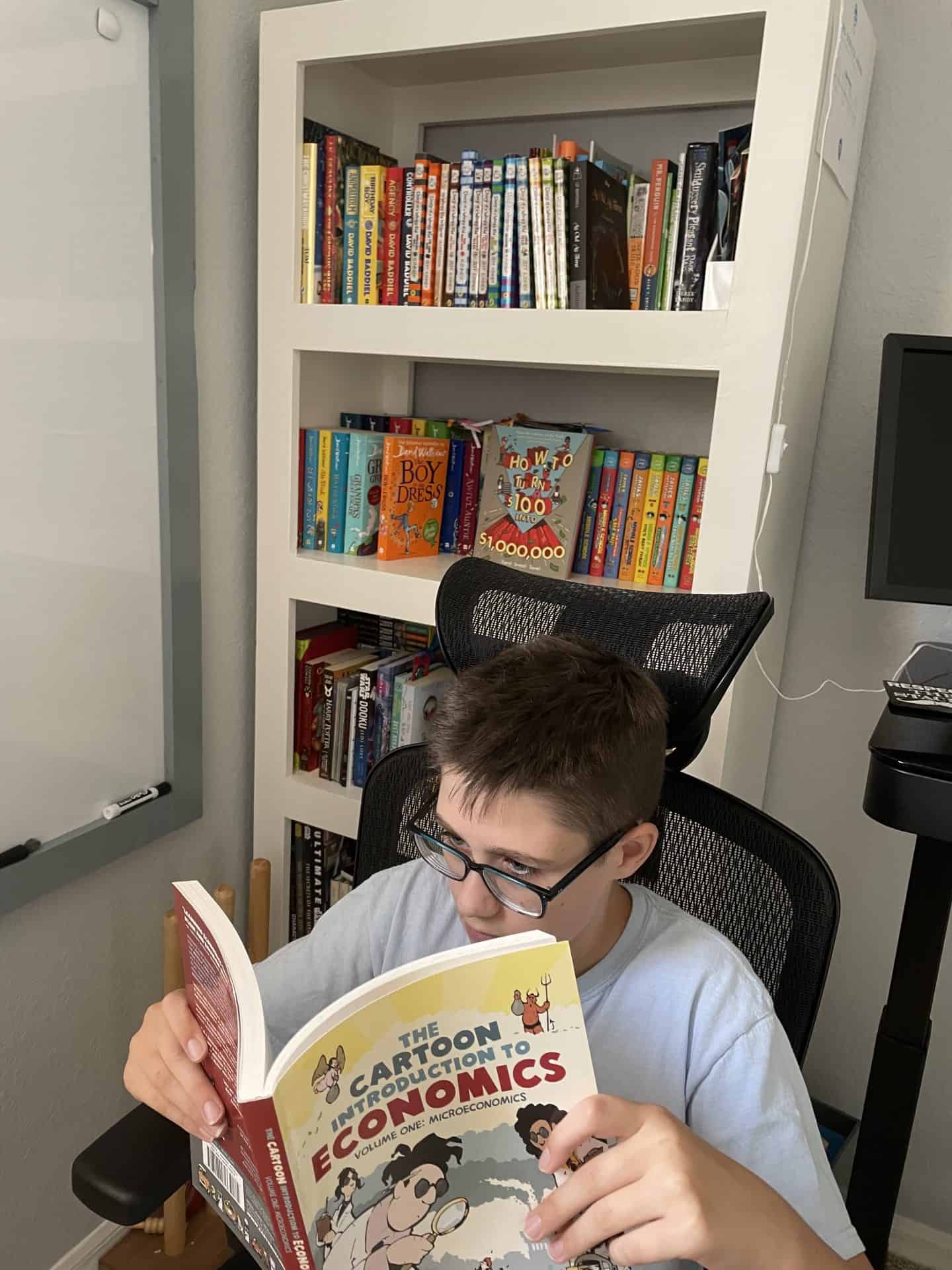

- Cartoon Introduction to Economics – If traditional economics feels heavy, this is a lighter entry point. The illustrations make supply and demand easier to grasp.

Free Financial Literacy Resources for Middle School

You don’t need to spend money to teach money skills. Several organizations offer structured, free lessons that work well for middle school students.

Choose Fi provides a full K–12 curriculum, including around 50 free lessons suitable for middle school. The lessons focus on budgeting, saving, and understanding how money decisions affect long-term goals.

FDIC (Federal Deposit Insurance Corporation) offers a downloadable curriculum for multiple grade levels. It’s more traditional in format but solid if you prefer guided lesson plans.

Actuarial Foundation has a four-part program that leans slightly older but can be adapted for middle schoolers who are ready for deeper discussions around risk, planning, and real-world scenarios.

Many high school–level resources can be simplified and used with middle school students, especially when paired with discussion or practical examples.

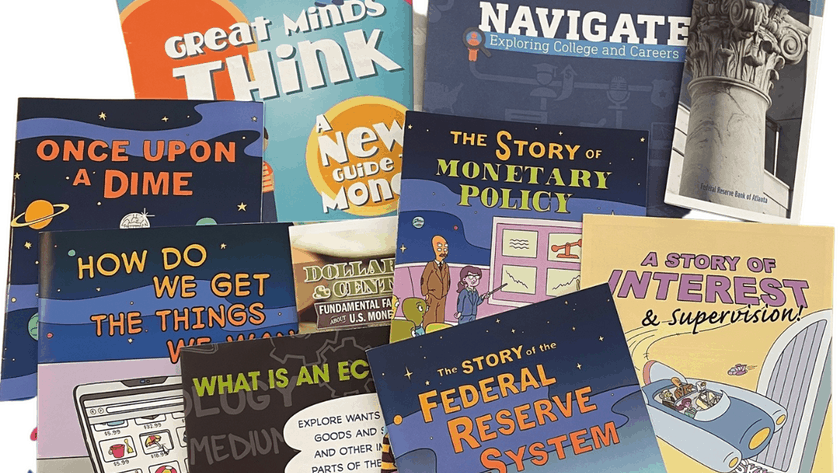

Financial Literacy Books and Workbooks

Several Federal Reserve banks provide free print materials that work well for reinforcing money concepts at home or in the classroom.

While some are designed for upper elementary students, many can be adapted for middle school.

The Federal Reserve Bank of Atlanta offers printable worksheets and large-format classroom posters that cover budgeting, saving, and economic basics.

The Federal Reserve Bank of New York provides up to five comic-style workbooks, along with lesson plans across grade levels. The visual format makes more complex topics easier to introduce.

The Federal Reserve Bank of Dallas has downloadable workbooks and activity sheets, including materials suited for older middle school and early high school students.

These resources are useful for supplementing structured lessons or adding variety without increasing your curriculum budget.

Last Updated on 13 February 2026 by Clare Brown

Please take a look at Next Gen Personal Finance, http://www.ngpf.org, Our curriculum is used by more than 50,000 personal finance teachers. Oh and it’s FREE!

Great thank you for sharing, I will certainly be checking this out 🙂