23 Free Financial Literacy Worksheets for Kids K-12

Looking for a fun and effective way to teach kids about money? Explore these free financial literacy worksheets for kids of all ages, from kindergarteners to high school students.

These engaging resources cover everything from identifying coins to planning budgets, empowering young minds with essential money management skills.

Enhance your best homeschooling resources with interactive board games and online simulations, ensuring your children build a strong foundation for a bright financial future.

By equipping them with these invaluable tools, you can instill a sense of financial confidence in your kids. Preparing them to make informed decisions and thrive in an increasingly complex financial world.

**This post may contain affiliate links. As an Amazon Associate and a participant in other affiliate programs, I earn a commission on qualifying purchases.**

Empower your children with the knowledge and skills they need to become financially responsible individuals. Setting them on a path toward financial success.

What is financial literacy?

Financial literacy refers to the knowledge, skills, and understanding of various financial concepts and tools that enable individuals to make informed and effective decisions about their personal finances. It involves being knowledgeable about managing money, budgeting, investing, saving, borrowing, and planning for the future.

Financially literate individuals have a better understanding of how money works, and they can navigate financial challenges more effectively. They can make sound financial decisions, avoid debt traps, and plan for their financial goals. Such as buying a house, saving for retirement, or funding their children’s education.

Key aspects of financial literacy include:

- Budgeting. Creating and following a budget helps individuals track their income and expenses. Ensuring they spend within their means and save for future needs.

- Saving and Investing. Knowing how to save money and invest it wisely allows individuals to grow their wealth over time and achieve long-term financial goals.

- Debt Management. Understanding the implications of debt and using it responsibly. Such as managing credit cards and loans, is essential to avoid falling into debt traps.

- Retirement Planning. Being aware of retirement options, such as pensions, 401(k)s, or individual retirement accounts (IRAs), helps individuals plan for a comfortable retirement.

- Financial Products and Services. Understanding financial products like insurance, mortgages, and various investment options empowers individuals to choose the right ones for their needs.

- Risk Management. Being aware of financial risks and how to protect against them, such as through insurance coverage, is crucial for financial security.

Financial literacy is not only important for personal financial success but also for making informed decisions as consumers. It is a vital life skill that empowers individuals to take control of their financial future and make choices that align with their financial goals and values.

At what age should children be introduced to financial literacy?

Financial literacy education can begin at an early age. And introducing children to basic financial concepts at a young age can have long-lasting benefits. Ideally, parents can start teaching financial literacy as soon as children show an interest in money or basic math skills. This often occurs around the age of 5 or 6.

At this age, children can grasp simple concepts like recognizing different coins and bills. Understanding that money is used to buy things, and learning the value of saving. Piggy banks can be used as hands-on tools to help children see the accumulation of money over time.

As children grow older, usually between the ages of 7 and 12. They can be introduced to more complex financial concepts, such as budgeting, distinguishing between needs and wants, and setting financial goals. Parents can involve them in family financial discussions. Like planning for vacations or managing household expenses, to provide real-life learning experiences.

Teenagers can learn about more advanced financial topics like banking, credit, investing, and the importance of staying out of debt. High school is an excellent time to teach about budgeting for personal expenses. Understanding the cost of college, and preparing for financial independence.

Financial literacy worksheets for kids

Financial literacy is a crucial life skill, and providing children with the right tools to understand money management from an early age is vital.

With a collection of free financial literacy worksheets tailored for different age groups, children can develop valuable money skills through engaging and interactive activities.

From kindergarteners learning about coins and savings to high school students planning budgets and exploring the intricacies of taxes. These worksheets offer a comprehensive and age-appropriate approach to fostering financial responsibility.

Kindergarten

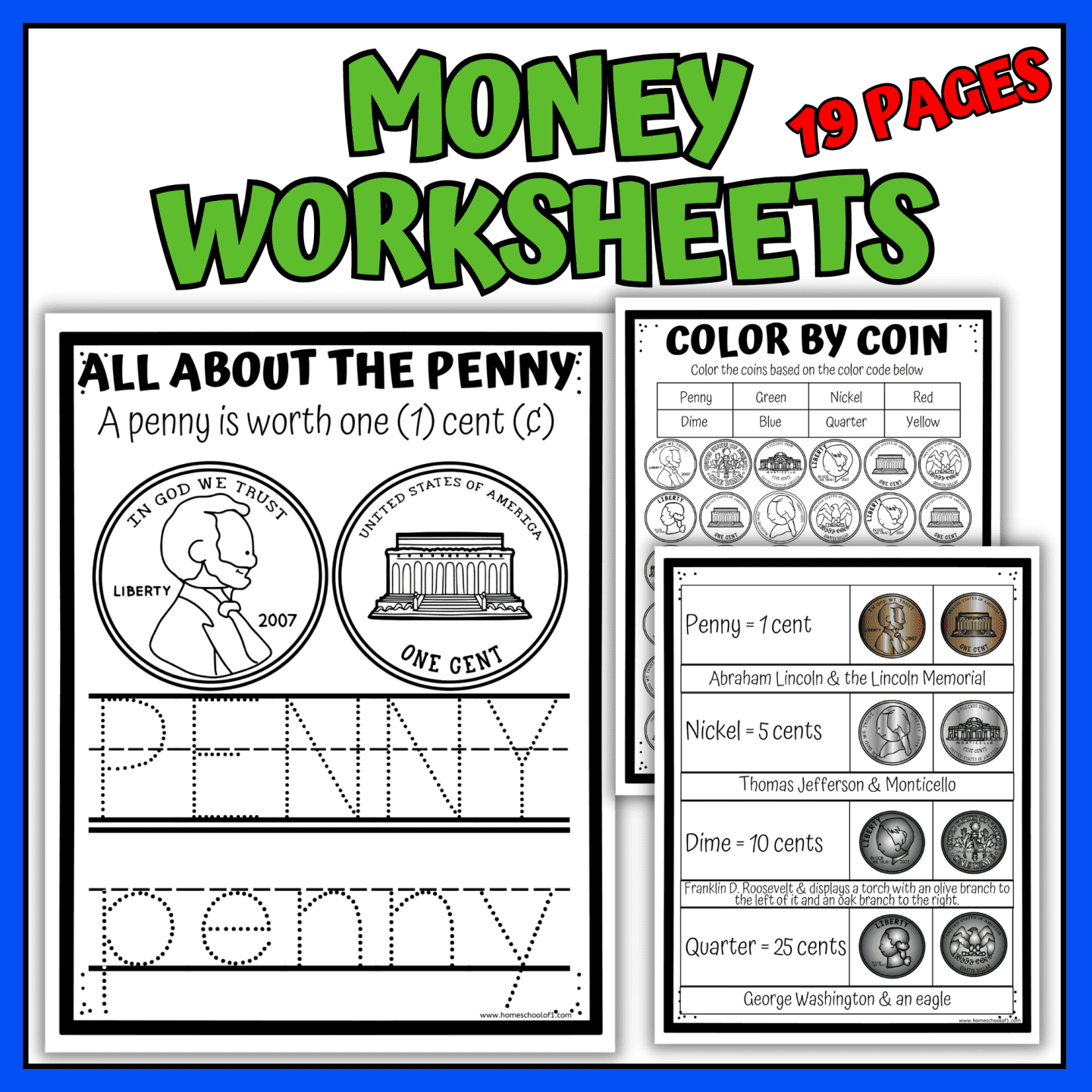

- Free printable coin identification worksheets

- Playing a need or want game from Consumer Finance

- Earning money from Practical Money Skills

- An introduction to saving and spending for young kids from TD Bank

Elementary grades

- Shopping math worksheets

- Printable chore cards

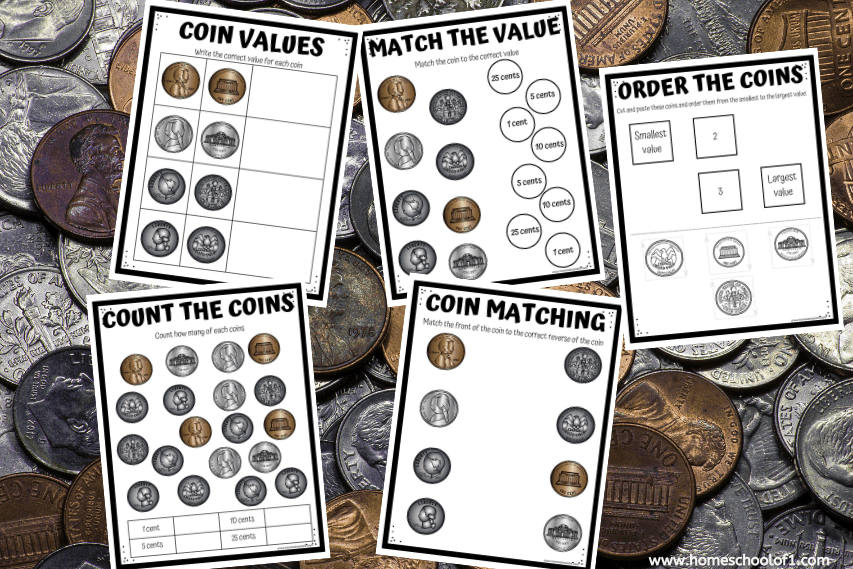

- Free printable money worksheets

- Financial literacy crossword

- Managing your money journey from Consumer Finance

- Making spending choices from Consumer Finance

- How to write a check from TD Bank

- Allowances and money responsibility from Practical Money Skills

Middle school students

- How to be a smart consumer from Biz Kids

- Examining the statistics on fraud and identity theft from Consumer Finance

- How to balance a checkbook from TD Bank

- Financial decisions and credit card basics from Practical Money Skills

- Understanding price elasticity from Atlanta Fed

High school students

- Risk and return from Atlanta Fed

- Planning a budget from TD Bank

- Building your future from Young Minds Inspired

- Calculating rate of return from Consumer Finance

- Building wealth lesson plans from Dallas Fed

- Avoiding debt and managing salary from Practical Money Skills

- Becoming familiar with taxes from Consumer Finance

Financial literacy games

Financial literacy games encompass a diverse range of formats, including printable money activities for kids, interactive board games, and online simulations.

These games creatively blend education with entertainment. Making learning about money enjoyable and effective for all ages.

By engaging kids in hands-on financial scenarios and decision-making, these games equip students with valuable money management skills and promote financial confidence for a secure future.

- Money management games for kids

- Printable money matching pairs game

- Your income and expenses game from FDIC

- Managing debt online game from FDIC

Financial literacy books for kids

Books that teach financial literacy to middle school students are a wonderful addition to these free financial literacy worksheets because they offer engaging and interactive ways to teach children about money.

These books use relatable stories and characters to make financial concepts fun and understandable for young minds. Combining worksheets with books allows children to reinforce their learning through different mediums, enhancing their financial literacy skills effectively.

- The Economics Book: Big Ideas Simply Explained

- The Infographic Guide to Personal Finance: A Visual Reference for Everything You Need to Know

- Investing for Kids

- Finance 101 for Kids

- How to Turn $100 into $1,000,000: Earn! Save! Invest!

- Cartoon Introduction to Economics, Volume I: Microeconomics

Financial literacy curriculum

These homeschool financial resources provide engaging and practical lessons, equipping students with essential money management skills and preparing them for a financially successful future.

Enhance your homeschooling journey with these valuable financial education programs:

- Review of Moneytime

- High school economics for homeschool with Mr. D. Math

- Financial literacy for teens from Beyond Personal Finance

Last Updated on 6 May 2025 by Clare Brown