Best Money Board Games for Kids and Families

The best money board games make learning about finances easy and fun, turning important skills into engaging activities.

We’ve tried many of these during our family game nights, and some have become favorites.

Whether it’s counting coins, managing allowances, or making strategic investments, these games offer something for kids of all ages.

From simple introductions for younger kids to more complex challenges for teens, these top board games for kids bring a mix of learning and fun to the table.

**This post may contain affiliate links. As an Amazon Associate and a participant in other affiliate programs, I earn a commission on qualifying purchases.**

Best Financial Literacy Board Games for Young Kids

Introducing children to financial concepts early helps build the foundation for responsible money habits later in life. These educational family board games are designed to teach kids the basics of money management—like spending, saving, and decision-making—through play.

Whether they’re practicing counting coins or learning about smart financial choices, these games offer an interactive and engaging way to introduce kids to essential money skills. They’re perfect for family game nights and work well as part of money activities for kindergarten and beyond.

We’ve played Monopoly Junior countless times, and it’s become a favorite in our house. It simplifies the traditional Monopoly experience, with fewer rules and smaller numbers, making it easy for younger kids to grasp. My child loves collecting properties and handing out “rent” – without even realizing he’s practicing early math! This version works well as an introduction to concepts like buying, selling, and handling small sums.

- Players: 2-4

- Age: 5+

- Tip: Use this game to spark conversations about saving for future rounds versus spending immediately.

Related: Printable money memory game

This game is a fantastic way to reinforce coin recognition and counting skills. We noticed that after a few rounds, our child was much quicker at identifying coins and adding them up. It turns learning into a race—something our competitive little one really enjoys! Plus, it introduces the idea of exchanging coins, which is a useful skill when learning real-world money management.

- Players: 2-4

- Age: 7+

- Pro Tip: Let your child act as the “banker” to boost their confidence in handling money.

Related: Shopping math worksheets

This card game adds a fun twist with its mix of strategy and luck. We love how it challenges our child to think ahead and protect their “assets.” It’s also a great game for teaching how to handle setbacks since players will inevitably lose some of their hard-earned assets. This game always brings out a lot of laughs (and some friendly rivalries) during family game nights.

- Players: 2-6

- Age: 7+

- Note: If your family enjoys a bit of competition, this one’s a hit.

This simple yet engaging game does a great job of demonstrating how money flows in and out—just like in real life. My child quickly picked up the idea that earning isn’t enough; it’s about managing what you have. It’s become a go-to for us when we want to mix fun with practical learning. The best part? Pay Day plays quickly, making it perfect for shorter game nights.

- Players: 2-4

- Age: 8+

- Tip: Use this game to introduce the concept of budgeting in a fun way.

Related: Free money worksheets

This game has been a family staple for years. It provides plenty of opportunities to talk about big life decisions—like saving for college, choosing a career, or starting a family. We enjoy discussing the choices along the way and the financial impact they have on the game. It’s a great way to introduce older kids to the idea that life decisions come with financial consequences.

- Players: 2-4

- Age: 8+

- Suggestion: Play this game together when introducing conversations about long-term goals, like saving or investing.

Best Money Card Games For Kids

As kids grow, so does their understanding of money and its complexities. Transitioning from play money to real-world currency becomes easier with games that challenge them to count, calculate, and make strategic choices.

These card games go beyond basic math—they enhance numerical skills, teach the value of different denominations, and introduce key financial concepts like saving, budgeting, and smart spending. Plus, they bring families together through fun and friendly competition.

This simple but fun game is a favorite in our house. It’s perfect for reinforcing money-counting skills and gives kids plenty of practice making exact change. Matching coins during gameplay has helped my child build confidence with real-world transactions. It’s also fast-paced, which keeps everyone engaged.

- Players: 2-6

- Age: 6+

- Tip: Use it to spark discussions about making change while grocery shopping or at the store.

- Related: Free coin identification worksheets

This game stands out with its fun rhyming cards and a mix of strategy and luck. It’s interactive and encourages kids to think quickly, block opponents, or steal their earnings—introducing them to financial competition. While designed with adults in mind, younger kids can enjoy it with guidance, making it a great option for family game nights.

- Players: 2-6

- Age: 6+

- Note: It’s great for kids who love games with a playful twist, thanks to the fun rhyming mechanics.

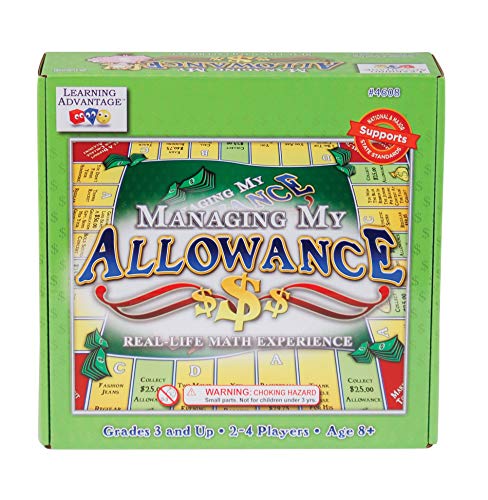

This game offers more than just fun—it teaches kids the difference between wants and needs while helping them manage wages and allowances from real-life tasks. My child loves keeping track of earnings on the included financial record, which makes saving feel like a real achievement.

- Players: 2-4

- Age: 8+

- Tip: Pair this game with real-life allowance tracking to reinforce the lessons.

In this light-hearted game, kids try to build savings by creating businesses and managing their spending. We’ve found it’s a great way to teach the value of saving small amounts over time, and the challenge of making change keeps younger players on their toes. It’s simple enough for younger kids but engaging enough to become a regular part of our game nights.

- Players: 2-4

- Age: 5+

- Pro Tip: Use real coins alongside the game money to reinforce lessons about currency.

Best Board Games about Money For The Family

Family game nights are a perfect way to introduce financial literacy concepts in a relaxed, enjoyable setting. These games go beyond traditional teaching methods, making complex financial ideas like budgeting, saving, and investing accessible to kids. They also encourage open conversations about money and provide hours of entertainment for everyone involved.

Whether it's a new twist on a classic or a game focused on financial decision-making, these options blend learning with fun, ensuring meaningful family time that also teaches valuable life skills.

Monopoly gets a digital upgrade! With a banking unit and cards instead of cash, this version introduces kids to the basics of credit and debit cards. We found it a great way to spark conversations about digital payments, interest, and financial responsibility. Plus, it keeps things exciting—everyone loves watching their balance change with each move.

- Players: 2-4

- Age: 8+

- Tip: Use it to discuss the pros and cons of using cards over cash.

Inspired by Rich Dad Poor Dad, this game introduces kids to the principles of cash flow and smart investing. It simplifies financial concepts like passive income, making it easy for young players to grasp. We love how it emphasizes the importance of long-term planning and thinking beyond just earning a paycheck.

- Players: 2-6

- Age: 6+

- Pro Tip: Pair it with a discussion about budgeting or allowances for added value.

This game has become a hit at our house! With options to invest in candy factories or high-tech labs, kids quickly get the hang of how investments can grow (or shrink). It’s lighthearted, fast-paced, and filled with opportunities to talk about financial risk-taking in a playful way.

- Players: 2-5

- Age: 8+

- Note: Perfect for kids who enjoy strategy mixed with a little silliness.

Best Money Management Games for Teens

These board games are perfect for older kids, teens, and adults, offering an enjoyable way to explore financial topics like entrepreneurship, the stock market, and money management.

From starting a business to mastering trading strategies, these board games for teenagers make complex concepts approachable while keeping the fun alive.

If you're looking to dive deeper into financial literacy, explore our favorite financial literacy curriculum for middle school students.

For high schoolers ready for advanced topics, Beyond Personal Finance is a valuable resource—check out our review for more insights.

This game is a fantastic way for older kids to explore what it takes to start and manage a business. From handling loans to managing marketing expenses, it challenges players to think like business owners. We’ve enjoyed how it encourages conversations about entrepreneurship and the realities of running a business.

- Players: 2-6

- Age: 12+

- Tip: Use this game as a springboard for discussing real-world business ideas.

- Related: Financial literacy books for middle school

This game simulates the ups and downs of trading, encouraging strategic thinking and quick decision-making. We’ve had fun seeing who could corner the market during family game night! It’s great for introducing concepts like supply and demand in an approachable way.

- Players: 3-6

- Age: 10+

- Pro Tip: Follow up with a conversation about current stock trends to connect the game with real-world finance.

This version of CASHFLOW is ideal for teens ready to take their financial knowledge to the next level. It covers concepts like escaping the "rat race" and building passive income streams. It’s a bit more complex but offers a rewarding experience for older players.

- Players: 2-4

- Age: 14+

- Note: This game pairs well with lessons on personal finance and investment strategies.

Bulls and Bears teaches financial planning through saving, spending, and investing. It’s a great tool for introducing kids to stock market concepts and the difference between bullish and bearish market strategies. We’ve found it helpful for starting conversations about financial trends.

- Players: 2-6

- Age: 14+

- Pro Tip: Use this game as an opportunity to explain financial news and market trends in simple terms.

This game brings out the inner gangster (in a playful way) with foam pistols and competitive strategies. While it’s lighthearted, it’s important to emphasize that it’s purely for fun. We’ve found that older kids enjoy the humor and strategy, but we wait until about age 12 to play, so everyone understands the difference between the game and reality.

- Players: 4-8

- Age: 10+ (Recommended 12+)

- Note: A fun way to introduce negotiation skills, but play with care.

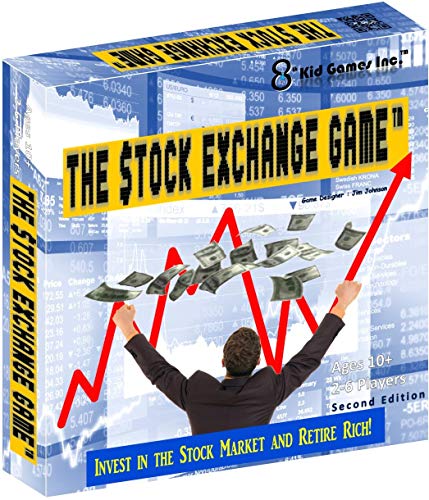

With three levels of play, this game is adaptable for families and more advanced players. It’s based on real stock market principles, making it a fantastic learning tool for kids interested in finance. We like how it allows for different strategies, from conservative to aggressive investing.

- Players: 2-6

- Age: 10+

- Pro Tip: Use it as a starting point for talking about how investments grow over time.

Last Updated on 8 April 2025 by Clare Brown